Stimulus Check: What To Expect

As an Amazon Associate I earn from qualifying purchases. We may earn money or products from other companies mentioned in this post at no cost to you!

Reading Time: 3 minutesWith the $1.9 trillion dollar spending package that has been passed by Congress and signed into law, which includes direct payments to individuals, here’s what you need to know.

How Much Will My Stimulus Check Be?

Getting right to the good stuff: Individuals should be getting up to $1,400 in stimulus checks, and $2,800 for married couples.

If you filed a tax return in 2019 or 2020, you are eligible.

Keep in mind that only single filers that earn less than $75,000, $112,500 for those that file as “head of household”, and couples earning less than $150,000 will be eligible for the full amount. These limits are a reduction from the first stimulus payments in 2020. The stimulus payment starts to be reduced incrementally and phased out completely for individuals making $80,000, $120,000 for “head of household”, and for couples making $160,000.

Also keep in mind that this is based on your AGI, not your gross income. If you’re unsure what your AGI is, go back to your most recently filed tax return. If you filed a form 1040, it’s line 8b; and line 4 if you filed a 1040EZ.

Here is a calculator to help determine what your stimulus check will be if the bill is signed with no other changes: stimulus check calculator.

Stimulus Checks For Dependents

If you have dependents, you also should get $1,400 per dependent. This is a huge increase from the previous rounds! There is no limit to how many dependents would receive the stimulus.

Unlike previous rounds, any adult dependent will also be eligible for a stimulus payment.

If you are not eligible for a stimulus check due to the income limits, you will also not be eligible to receive payments for any dependents.

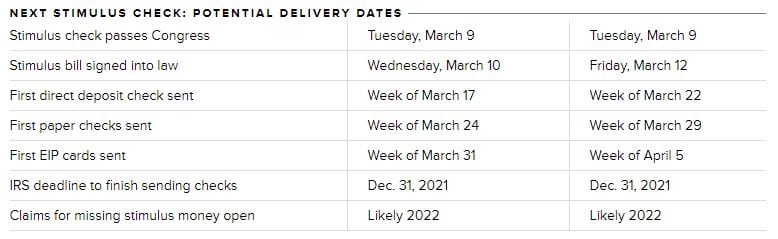

When Will I Get The Second Stimulus?

Keep in mind that you’ll receive your stimulus check in the same manner you receive any tax refunds. If you have a direct deposit account listed on your tax return, you’ll receive your stimulus there. If you received paper checks in the past, you’ll receive a check. The electronic disbursements will be delivered first, followed by the paper checks.

Here is a projected set of dates of when you could receive your check if no other delays occur:

Adding direct deposit information to your 2020 tax filing, if you haven’t filed already, could help speed up your receipt of this new stimulus. Take advantage of this timeframe if you don’t already have this included on your tax return.

Other Things To Know

An additional $300 benefit for those who are currently collecting unemployment is included with the bill. This additional payment extends this enhanced benefit from March 14 to September 6.

While there are still a couple of steps for official approval, Congress is attempting to make the first $10,200 of the unemployment benefits non-taxable.

These stimulus payments are also not taxable income! Remember that when you file next year.

Closing Thoughts

Now having passed all approval hurdles, we’re all just waiting on our checks!

When the stimulus checks do arrive, please consider doing one of the following when you receive your check:

If you’re looking to seed some sort of savings account, check out SuperMoney to compare different accounts to find the best interest rate or terms.

Be sure to also check out CIT Bank as they typically have higher interest rates due to low overhead costs, and frequently have sign-up bonuses!

You can even search and compare brokerage accounts with SuperMoney if you plan to use your stimulus check to finally start investing.

I hope this was helpful and has given you some ideas of what to do with your stimulus check!

RELATED

See how to use extra money to boost your savings

See why you should use bonus money to pay off debt

IF YOU WANT TO SEE MORE…

Consider subscribing to my e-mail list. You can always unsubscribe, I won’t spam you!

Follow me on Facebook, Instagram, or Twitter.

Save this post on Pinterest by using the share buttons, and follow me, too!

If you want to start a blogging business, check out this FREE course!

If you want to make money from a blog, check out this program that got me started making my own money blogging!

2 Comments

Lettie

I could not resist commenting. Very well written!

zortilo nrel

Some genuinely interesting points you have written.Helped me a lot, just what I was searching for : D.