Know Your Worth! Net Worth, That Is

As an Amazon Associate I earn from qualifying purchases. We may earn money or products from other companies mentioned in this post at no cost to you!

Reading Time: 5 minutesDo you know your net worth? A lot of people don’t, yet I think it is one of the most important numbers you can understand about yourself. Don’t you want to know if you’re a millionaire or not?

I’m kidding a little, but it is true that there is this misconception about when one can actually designate themselves a millionaire.

It seems a lot of people think it’s how much money you have. Others believe it’s tied to how big your salary is. These are both incorrect, at least by themselves.

You’ve truly reached millionaire status when your net worth is over a million! If your goal is to be a millionaire, it might be important to know what factors will actually determine whether you are one or not.

I’m going to tell you how to calculate your net worth and why it’s important to your long-term wealth goals.

How To Calculate Your Net Worth

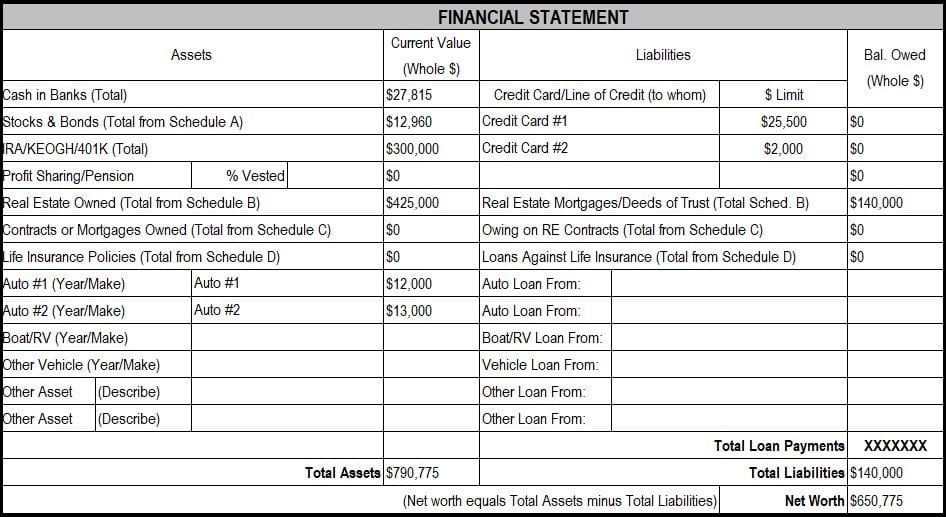

This is pretty simple and takes only a few minutes to calculate. You need to calculate your assets minus your liabilities.

Assets are your cash, stocks, retirement accounts, house, and you can throw in vehicles, RV’s, valuable jewelry, etc. if you want to dive that deep into it.

I do include the depreciable assets like cars and RV’s because they still have a value, and you could receive a good chunk of money if you were to sell them.

How you should be listing these on your personal financial statement is at their current market, or liquidation, value. For a house, you could go to any house selling site and get a ballpark value for your home. You only listing the full value of your home, don’t include any debts against it in this part.

As I said above about the cars, what is it you think you can reasonably get if you were to try to sell your car today? That would be it’s value.

As an FYI, for lending purposes, most lenders would exclude depreciable assets and personal property from your net worth.

Liabilities are anything you owe, i.e. credit card balances, car loans, student loans, mortgage, etc. HELOC’s, of course, are also house debts, and you would list the amount as whatever the current balance is, not the full limit.

If you have any personal loans, or owe taxes, these are also liabilities. This should be pretty simple to add up if you already have a good handle on your debt situation.

You then subtract the liabilities from the assets and there you have it! It’s your net worth. Here is an example of what this would look like:

What Does This Tell You

Your net worth includes your assets and liabilities, which gives a more complete picture of your financial success.

Say, it equals around $500,000- You could say you’re a “half millionaire”, ha ha!

But let’s talk about an example of your friend who keeps trying to convince that he’s rich.

Your friend who makes $100K, bought a $700K house because he can “afford payments”, and has no savings or retirement. He has a good salary, nice home, goes to Vegas frequently, and always buys the expensive alcohol! He’s successful, right?

If he admits that he has $630K in mortgage debt and $80K of student loan debt, he actually has a negative net worth. He’s $10K in the red. That’s not even including all the loans for other toys he has, or any credit card debt.

If you calculate a negative net worth, you are not wealthy. It means you’re under water.

I don’t care if you have a million dollar home. If you also have debts that are a $1,050,000, you are not a millionaire!

Why Knowing Your Net Worth Is Important

The average net worth for millennials is $8,000! That might be good for someone just out of college, but this average was from a sample from 20-35 year-olds!

If your goal is to one day become a millionaire, whether it’s for financial security or leaving a legacy, knowing what makes up your net worth will help you get there. Check out this post from Financial Alien to see a further break down of net worth by age group.

Knowing your net worth number helps you define your financial goals, and gets you to focus on the right things in order to build wealth.

Some people are only focused on accumulating things. Others are focused on retirement accounts. Others are focused on making more money. These can all be factors in long term wealth building, but you’ll find yourself struggling or treading water if you’re only focusing on these individual things.

For instance, when you were focused on paying off all your debt, your goal was to get to zero. That’s an easy goal to visualize. For me, I had to work to shift the gears in my mind to make a new financial goal that involved numbers going UP!

It’s a mindset shift from watching something go down (your debt) to aiming to make something go up (your assets/net worth).

How Often You Should Check Your Net Worth

I joke about how often I check my net worth (because it is a lot), but I feel justified doing it.

My feeling is that I wouldn’t only check my budget once a year, once a quarter, and not even just once a week! While it’s not necessary to update it that often, I think that at least checking it somewhat frequently- especially while you’re paying off debt- can be very motivating.

Now that I don’t have debt (besides the mortgage), it takes more to see that net worth number grow. It’s more motivating for me to save or invest more to keep the same kind of momentum as when I was paying off debt!

Think of it as your grade on your financial report card. It’s a measure of your financial health. You should at least be checking it regularly.

Closing Thoughts

Knowing your net worth tells you what levers to pull to improve it.

Maybe your debt is holding back your net worth, so you’ll be focused on paying that down.

You might decide you need to increase your assets, possibly by investing more.

These are all positive actions that will provide you financial security, and help you grow your net worth. Tracking your net worth is going to motivate you to do these things, which is why it’s so important.

RELATED

See this post about paying off debt fast

Learn how to budget so you can grow your net worth!

IF YOU WANT TO SEE MORE…

Consider subscribing to my e-mail list. You can always unsubscribe, I won’t spam you!

Follow me on Facebook, Instagram, or Twitter.

Save this post on Pinterest by using the share buttons, and follow me, too!

If you want to start a blogging business, check out this FREE course!

If you want to make money from a blog, check out this program that got me started making my own money blogging!

18 Comments

Tammy Horvath

My bank makes me calculate our net worth every year for their file. I was amazed the first time I did it. It always gives me a clear perspective on what I need to do to make my future better.

Elizabeth

I’ve been trying for years to get myself out of debt. And I never thought to figure out my net worth. I’ve read plenty of articles about finance and I have to say it’s quite refreshing to read an article from a woman with an MBA. I’ve worked in accounting for years and it’s a very male-based career. I will definately be coming back for more!

Ashley

Aw, how kind of you! We definitely work in male-dominated industries.

Emily

Omgsh the average millennial. So painful! I’m a always shocked when I read the stats that people don’t have even a small emergency fund in the bank for unexpected things. I am not sure I have ever actually calculated my net worth however. I know I’m not at the millionaire status yet 😆

Marianne

I can’t say that I have ever calculated my net worth… or have been asked to. Interesting.

Gina

This is great information to have, and can be a very sobering exercise. My investment guy recently had me calculate my net worth and it was a great exercise!

Ashley

Nice! So you’re already aware of the benefits!

Sabrina DeWalt

Very interesting. I have never thought about calculating my net worth.

Stephanie

I’ve never calculated my net worth. Now I want to figure it out! Thanks for the info.

Ashley

It can be an eye opener! And gives you some new goals!

Barbara

Seeing on paper how to calculate this confirms what I already know, but it is a good review! Yes! Important info to keep cognizant!

Jason Gowin

I had never even thought to check out what my actual net worth may be. I know what the internet celebrity worth page tells about me…but it is grossly inaccurate.

Cindy

This is an excellent idea! Thank you.

Angela

This is super helpful. I set up a spreadsheet years ago to track all this – sure wish I had this post before I did all that!

BearMoney Dan

100% agree that seeing the debts laid out there in black and white is just as important as the assets. Debt has a nasty habit of both being there every hour but also hidden in the background of your finances!

Robyn

It is so important to know all your numbers! Having it all laid out and written for you to see visually is a great way to really get a handle of where your finances are.

What a great post!

Cristian @ Financial Alien

Straight to the point, great post, Ashley! And I totally agree with you; tracking your Net Worth is very important. While there is more to it than just the number, your Net Worth is an important metric to keep track of to see your financial progress over time.

Steve @ The Frugal Expat

Knowing your net worth can really help you make plans for your future. This is a great article to point to those things. You can see your debt plus your income. It is a great thing to track and keep track of to make sure you are achieving your financial goals.