Big Tax Refund: Not a Good Thing

As an Amazon Associate I earn from qualifying purchases. We may earn money or products from other companies mentioned in this post at no cost to you!

Reading Time: 5 minutesI know that tax season is some people’s favorite time of year because they’re expecting a large tax refund. Who wouldn’t want a big, fat check, right?!

I know you’re all going to think I’m crazy for saying this but here goes: I am a strong, strong believer that getting a big tax refund is not a good thing.

Let me make that stand out so you don’t miss it:

A BIG TAX REFUND IS NOT A GOOD THING

At the end of this, I’ll show you a compelling reason to keep your money now vs. getting a big refund, and show you how to calculate what your check should really be so you can do it well and not owe a large amount either.

I personally practice this, and was very proud of myself when I netted $40 between my Fed and State returns one year. I also used this practice to generate an extra $400 per paycheck that I used to help pay off our debt fast. You can read about it here.

Tax refunds are NOT a savings account

I’ve heard the arguments before about getting a big tax refund… “But that’s like I’m putting it in savings every paycheck”…

This is the space where the crickets chirp in the background and I blink in silence and disbelief at that person… Maybe I slap my palm on my forehead…

Never, ever, ever, EVER would I use the government as my piggy bank! If you are one of those people who just cannot save- yeah, maybe I could buy that having the most taxes taken from your paycheck is the only way you could save money. But, if you aren’t disciplined enough to save that money yourself throughout the year, chances are that you’ll spend it all when you get it in a refund anyway sooooo… still not a savings.

It’s not like you’ve suddenly received free money or a big bonus, either. That’s your money! You earned it, you’re just getting it back from the government! Why would you want to wait twelve months to get money that you earned? That money is better put to use paying off debt, padding your emergency savings (see tips here), or being invested in a retirement account.

If you are getting a big tax refund, that means that you’re not doing your paycheck correctly. More accurately, your withholding on your paycheck are out of whack, and your paychecks are smaller than they really should be.

You need to know your tax bracket

Your tax bracket is based on your AGI (adjusted gross income) on your tax return.

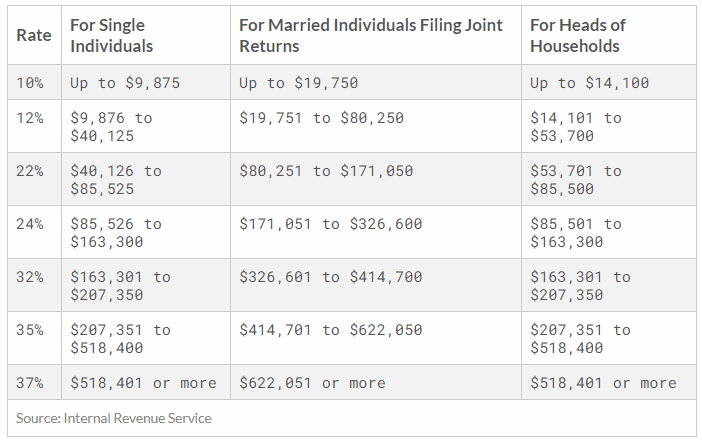

To find your tax bracket, you can search for “2020 tax brackets” and you’ll get any number of images that show the different brackets. Here is what you’ll be referencing when you file your 2020 tax returns:

This shows that if you filed single for 2020 and made between $40,126 and $85,525 in adjusted gross income, congratulations! You’re in the 22% bracket.

Unless you have major changes, like significant income increase, job loss, married, etc., you can assume you’ll probably be in the same bracket for 2021.

To determine if you’re paychecks are actually matching your tax bracket, take what you’ve paid in federal taxes and divide by your pre-tax earnings (gross wages less pre-tax items like 401K contributions, HSA contributions, medical/dental, etc.). If the amount matches your tax bracket- like the taxes on your paycheck are 22% of your pre-tax earnings- then you’re on the right track.

Calculate your new paycheck

A good way to dial in your withholding is to use a paycheck calculator. If you’ve never played around with a salary paycheck calculator, you should try the calculators provided by ADP. The “Salary Paycheck Calculator” will let you see the difference if you change your withholdings, and you can customize it by state so you’ll have an accurate picture to see what the difference would be to your net paycheck. They also have it updated for the new W-4 since allowances are no longer included for federal tax purposes.

Take a look at your current pay stub so you can plug in the items that are already coming out of your paycheck. You can include variables such as 401K contributions, HSA contributions, and any other items that are pre- or post-tax to fully understand what your net paycheck should look like.

Side note: I’d also encourage you to use this calculator to see how much more you could be investing in your 401K (or traditional IRA) and how that would affect your net income. More on that in this post.

Here’s why you shouldn’t want a big tax refund

Now, after making the effort to find out your new paycheck amount after adjusting your withholdings, your change may be so slight, like $50. You may think it’s not worth it, right?

Well, ADP also has this wonderful “Time Value Calculator” that can help you understand what you’re giving up by letting that extra $50 go to the government every paycheck instead of your investments.

If you invested that extra $50 every paycheck for 40 years, assuming an average rate of return of 7%, you’d have $287,271 at the end of that 40 years. Conversely, if you continued to use the government as your savings account, $50 on a bi-weekly schedule for 40 years: $52,000.

See why using the government as your piggy bank really costs you? If it were me, I’d want the bigger amount.

Closing Thoughts

You’re not going to get $0, exactly, that’s not the goal. You might owe a little, or get a $20 refund, or something small like that. I call that a win because that’s really darn close to zero! The goal is not to get a tax refund of several thousand dollars.

Are you ready to start your tax return now to see how you did with your withholding? I use FreeTaxUSA for filing my tax returns and I pretty much start right after year end- I’m one of those people.

Use this link to try out FreeTaxUSA. You can file your federal return for free, and they don’t charge you to re-print previous years! (Can you tell you I’ve had that problem from other well-known companies and find it annoying?)

Also, if you want to file a State return through FreeTaxUSA, sign up with Rakuten (you get a bonus, too!) and use their FreeTaxUSA discount code to get money back!

I hope you’ll join me in the “No tax refund!” movement. You earned that money. Put it to use for you now! Don’t wait for the government to give it back to you.

RELATED

How to build an emergency fund

IF YOU WANT TO SEE MORE…

Consider subscribing to my e-mail list. You can always unsubscribe, I won’t spam you!

Follow me on Facebook, Instagram, or Twitter.

Save this post on Pinterest by using the share buttons, and follow me, too!

If you want to start a blogging business, check out this FREE course!

If you want to make money from a blog, check out this program that got me started making my own money blogging!

8 Comments

Teresa somewhere in the Gorge

Very well explained!

Thanks!

Hairstyles

Thank you for sharing superb informations. Your web site is very cool. I’m impressed by the details that you抳e on this web site. It reveals how nicely you understand this subject. Bookmarked this website page, will come back for more articles. You, my pal, ROCK! I found just the information I already searched everywhere and simply could not come across. What a great web site.

FreshLifeAdvice

Amen! It’s always been a pet peeve of mine when friends brag about how big their tax refunds were. In reality, they were just giving the government a giant free loan for the year!

turkce

I have been looking everywhere for this! Thumbs up! Your article has proven useful to me. Great read. Darla Elton Joachim Aridatha Tedmund Mab

Hairstyles

I have been absent for some time, but now I remember why I used to love this web site. Thank you, I will try and check back more frequently. How frequently you update your web site?

Fashion

Howdy! This is my 1st comment here so I just wanted to give a quick shout out and tell you I truly enjoy reading your posts. Can you suggest any other blogs/websites/forums that deal with the same subjects? Thanks a ton!

Fashion Styles Ideas

Another thing I’ve really noticed is the fact for many people, poor credit is the results of circumstances over and above their control. Such as they may happen to be saddled by having an illness and as a consequence they have large bills going to collections. It may be due to a job loss or maybe the inability to work. Sometimes divorce proceedings can send the financial circumstances in a downward direction. Thanks for sharing your thinking on this blog.

manhwaland

I truly appreciate this blog article. Want more.