What Does Asset Allocation Mean?

As an Amazon Associate I earn from qualifying purchases. We may earn money or products from other companies mentioned in this post at no cost to you!

Reading Time: 4 minutesIf you’re new to investing, you might see the term “asset allocation” as your figuring out where to start. Let’s explore what exactly does asset allocation mean, why is it important, and what’s the best allocation for you!

What Is Asset Allocation

So you know what an asset is in physical terms: It’s a house, a car, gold bars, etc. It’s something tangible that holds a certain value. True asset allocation literally refers to all your assets that make up your net worth. This could be a mixture of real estate, stocks, bonds, cash, and maybe commodities if you own any.

When we’re talking about investing, though, asset allocation refers to portfolio diversification. We call it asset allocation, but it’s really your allocation of investment in specific asset categories. This is mostly likely what you’re really trying to find out.

Asset Allocation In Investing

If we’re simply talking about stocks, bonds, and commodities, you can break down your investments into multiple categories.

For instance, you might hear references to portfolios allocated at 60% and 40% bonds. That’s self-explanatory. There’s 60% in the stocks markets, whether it’s the Dow, Nasdaq, etc.; and then 40% of investments are in bonds.

In stocks, it’s common to be diversified amongst large cap, mid cap, small cap, and maybe international stocks. Companies are separated by size: large, medium, and small (there’s even “micro). When they’re grouped together by size in a single ETF or mutual fund, they are called large cap, medium cap, and small cap (“cap” stands for capitalization and refers to the company’s size). A mix of these is a pretty common asset allocation.

If you’re diversifying in commodities, you could be allocating money to oil, energy, livestock, wheat, etc.

Bonds can be broken down into different types, as well!

Long story short, there is a lot of ways you can diversify your investments!

Example Of Diversification

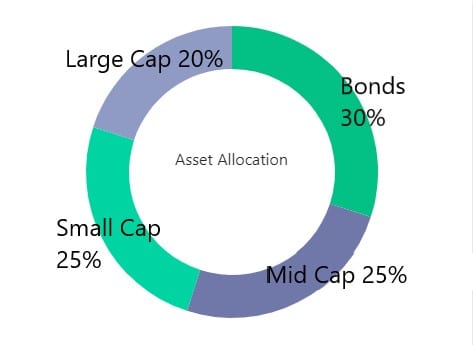

The most common visual representation of investment allocation is a pie. If you think of the values of your distinct investments, and then make pieces of a pie that correspond to the size of those values, this would be your asset allocation.

This is just an example of what your “pie” might look like when allocated to different assets. Note: This is not a real allocation of mine, just an example of what one would look like if allocated this way.

This example is pretty simplistic since it doesn’t include any real estate holdings or international stocks, but now you get the idea of what a diversified portfolio could look like.

Why Is Asset Allocation Important

You do this for diversification. It’s the concept of “not having all your eggs in the same basket”.

Imagine dumping all your retirement savings into Enron because it was only going up in 1990’s. You would’ve lost everything by 2001.

Diversification is to help manage the risk of investing, hedge against inflation, and increase your wealth overall.

How Should I Allocate?

Your personal allocation is, well, so personal! It depends on your risk tolerance, your goals, your investment horizon… There are so many factors.

For instance, including international stocks is a very common portfolio set up. However, I personally do not invest specifically in any international ETF’s or mutual funds. (Side note: I still have about 9% invested in international because of the funds that I am invested in, interestingly enough.) I choose not to because I’ve seen little benefit from doing so.

The idea of including international is that if US equities are doing badly, then the international stocks pick up that slack. In my opinion, if US equities are doing badly, so are international!

You will find many financial gurus out there that would definitely tell you that investing in international instead of 100% US stocks is a safer allocation for your portfolio. You can take their advice or not, it’s up to you. I know that kind of leaves you without guidance, but you really have to do your own research. It may take some trial and error before you decide what works best for you.

Closing Thoughts

Now that you understand what allocation is and the many ways you can diversify your investments, you’re set to start researching investments to allocate your money. You can search for these different asset categories in your ETF or mutual fund screeners in your investment platforms.

You can find these fund screeners on any investing platform, or places like Yahoo!Finance. Personally, I find M1 Finance to be the most user friendly, the most detailed, and the best in being able to easily keep your portfolio balanced according the allocation you’ve chosen. I’ve used other platforms before, and I currently still have accounts in two of them. I just recently started using M1 (so a third investing platform), and it’s now my favorite, by far! If you’d like to check out M1 Finance, click here.

Again, the proper asset allocation is the one that makes you feel the most comfortable. Don’t feel silly if you’re just starting out and keeping it simple. As you become more familiar with researching funds and investing, you’ll likely start branching out into other areas.

RELATED

See this post about index funds if you’re a beginner investor.

See this post if your 401K is currently your only investment account.

IF YOU WANT TO SEE MORE…

Consider subscribing to my e-mail list. You can always unsubscribe, I won’t spam you!

Follow me on Facebook, Instagram, or Twitter.

Save this post on Pinterest by using the share buttons, and follow me, too!

If you want to start a blogging business, check out this FREE course!

If you want to make money from a blog, check out this program that got me started making my own money blogging!

8 Comments

Adam Wilson

I like your thoughts on asset allocation and risk tolerance. People should really ask themselves some key questions to assess their own risk tolerance and how much risk will give them a good night’s sleep.

Beyond that, age is a compelling factor. Younger people can afford to take more risks because time is a powerful asset.

Ashley

I did not include age as a determining factor, but that is a very good point. It definitely makes a difference.

Robyn

Diversify! Diversify! Diversify! This is a great breakdown of what asset allocation is and how it translates to real-life investing.

Ashley

Thank you! I can see why it would feel overwhelming to newbies. There are lot of different sectors and asset classes they could sift through.

BearMoney Dan

It’s always an interesting seesaw when you allocate in a balanced manner, e.g. Oil stocks vs Green Energy stocks, will be interesting to see what a ‘broad basket’ will look like in 2030. Totally agree about ‘international’, very few high performing safeguard stocks out there.

Ashley

No kidding. It’s amazing how things have changed just in the last 10 years. And now there’s more talk of adding crypto to your diversification, which is interesting.

Cristian @ Financial Alien

Straightforward and to the point, Ashley. I love it! This is exactly the kind of information that someone new to investing needs.

As for my own allocation, I have a target of 60% Large Cap, 15% Mid Cap, 15% Small Cap, 5% International, and 5% Real Estate.

Actual allocation is slightly different, but I try to rebalance once or twice a year to stay as close to my target as possible.

Steve @ The Frugal Expat

Asset allocation is so important. You cannot put all of your eggs into one basket. You need diversification. This is a great concept to teach people. A lot of newbies want to invest in one or two things, and sometimes it doesn’t work out for them. They then quit.

I am glad you are writing about this to help people out.